Fear and Being “Normal”

By David DeBellis, CFA

Investor fears today are higher than they have been in quite a while. We have been spoiled by extremely low levels of stock market volatility over the last several years. Financial markets have seen a pickup in volatility, with broader equity indexes down 10% or more from their September highs. Add to this the constant barrage of news stories about the trade war with China and how it might affect growth in the economy, or Presidential tweets or troubles overseas, and many are left wondering if there is more pain to come for the markets.

Most individuals tend to be reactive and risk averse when it comes to investing in stocks. And for good reason – when it’s your money on the line, you appropriately feel like it’s a direct hit when the stock market doesn’t perform in your favor. There is no question that demand for investments is driven by both reason and emotion. It’s emotion that allows us to accept higher levels of risk when markets are rising and less when they are falling. In other words, we’re human!

Try as we might to curb our emotions, behavioral economists argue that biases are hard-wired into our brains and personalities: Some of us are overconfident, taking excessive risks; others too meek, seeking to avoid losses at the first sign of trouble. We’re also programmed to look for patterns in unrelated information – seeing

Elvis in a piece of bacon, or a cloud shaped like a fish. We cannot ignore or suppress them, but by recognizing them they can be managed. One strategy is to take a slower, more systematic approach to making decisions. Seek contrary opinions and go on a media blackout for a little while.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham We commonly equate risk to volatility, which can reinforce the behavioral bias of loss aversion. Volatility should not be what matters most to investors, especially those with a long-term time horizon. Instead, the most significant risk is that of a permanent loss of capital. Most causes of permanent loss of capital are self-inflicted. Failing to maintain enough liquidity to meet unexpected expenses increases the chance that you will need to sell at an inopportune time. Panic is another trigger of permanent loss of capital and provides another argument in favor of moderating the intake of financial news.

To mitigate risk of permanent loss of capital, portfolios should be constructed in terms of “buckets.” There should be a short-term bucket that provides liquidity for immediate income needs and unexpected expenses. This would be invested in a money market fund or other short-term fixed income investment. The intermediate bucket would be invested in slightly longer-term investments that can be easily liquidated in an emergency. These investments would consist of high-quality bonds or fixed income mutual funds. They would earn a slightly better return than cash, but without a large increase in short-term volatility.

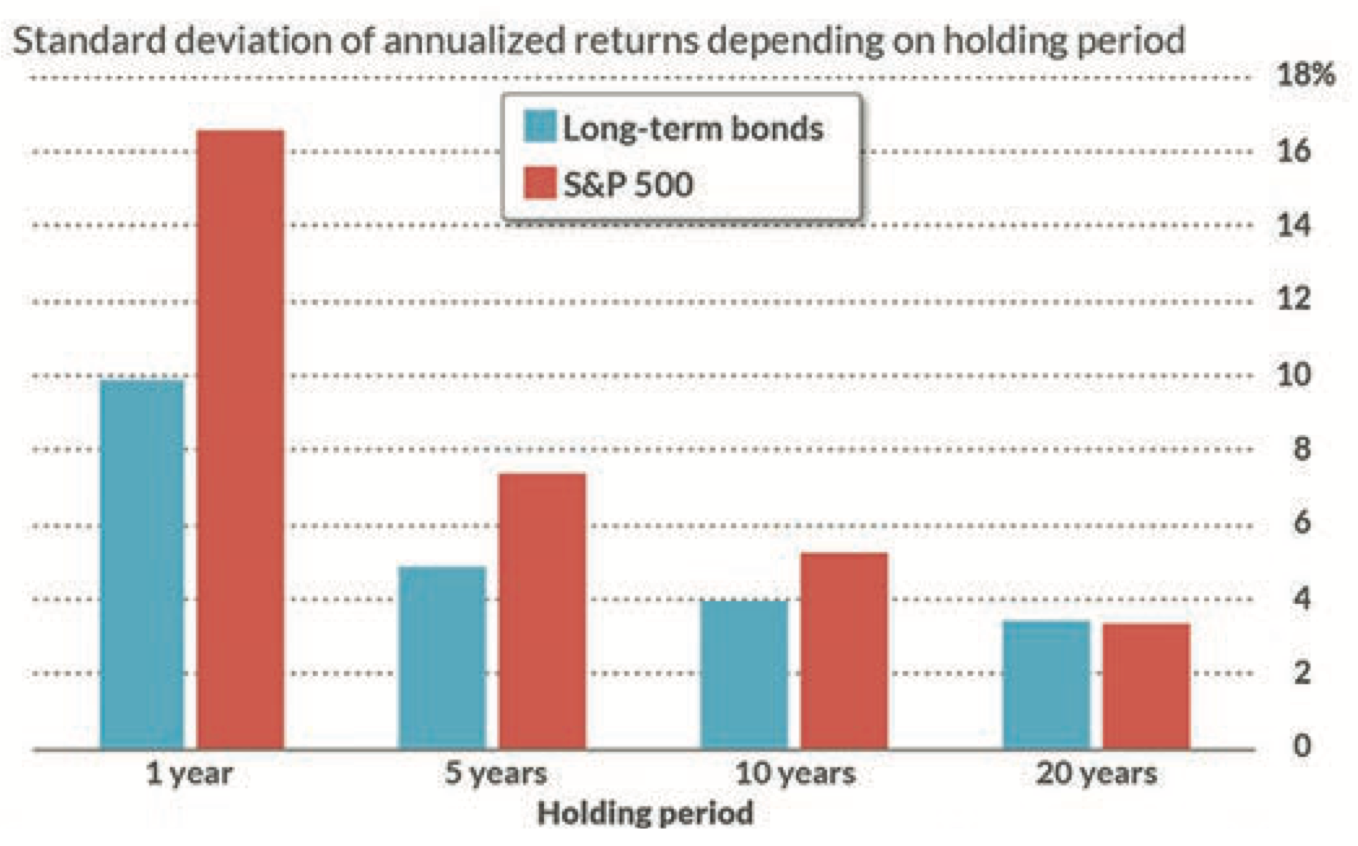

The last piece of the portfolio puzzle is the long-term bucket. This is the part of your portfolio that increases the amount of capital that you have to spend in the future. At a bare minimum, this is your hedge against inflation. This bucket is invested in equity securities; common stocks or stock mutual funds. This is the part of the portfolio that is going to be prone to great fluctuations in value over the short-term. But, if you can put your emotions aside and only look at this in longer-term increments, you will find that it really isn’t much riskier than owning bonds. But some people may look at the chart below and question their ability to not look at their portfolio and not worry about daily ups and downs of the stock market.

And that’s OK, since we are all “just human.” We all deserve a good night’s sleep, and if the stock market is keeping that from happening, then you should have a conversation with your portfolio manager. Now might be an opportune time to trim some of the equity risk in your portfolio. We are in the late stages of the longest economic recovery in our country’s history and had the longest running bull market as well.

However, remember that most of the signals that the media throws at us on a daily basis are just statistical noise. What you think may be a pattern in the market just might be as random as seeing Elvis on your breakfast plate.