How the Gun Taught Me About Evolution

By Jack Davidson

My role at Trust Company of Vermont is to review estate plans and collaborate with others who also do estate plans …..trust officers within the company, and lawyers and accountants. My preferred method of communication is storytelling, which has its benefits…..rarely am I asked to make public presentations.

In the past, estate planning often involved strategies to save estate taxes. Now that estate tax exemptions are significantly higher, far fewer estates are currently subject to the complex estate tax rules. Now, planners can truly focus on how to transfer wealth to others, and the impact on those receiving inheritances. Sometimes my view of tax saving plans are GMOs (genetically modified) and plans to take care of family members are Naturally Organic. Fortunately, in my world, I do not have to take a po- sition on whether GMOs are harmful. GMOs in our tax code are simply unavoidable, and they have not gone away. And we still have to deal with another GMO: the income tax.

In the past, estates were populated by assets held outright. Now the biggest challenge is the IRA and the 401(k), and the tax implications. Planning an estate using very complex tax rules can save signifi- cant income taxes, and many planners are suffering from IRS rules that are evolving, rather than stable enough to plan with certainty. Often planners come from different states, or different frames of mind. In Vermont, lawyers need to know the Vermont law but may not have experience with the income tax laws that affect estates, and accountants may not know the legal rules that have an impact on tax strategies.

Often when I thInk of evolutIon, I think of tribes. Sometimes I see 3 tribes in the estate planning world: trust officers, lawyers, and accountants. Our goal is to have all tribes work as one for the client, while addressing the evolution of learning, both increased understanding of laws, as further defined by case law and regulations, as well as changes in the law.

I grew up on Long Island. I never met anyone who owned a gun. I arrive in Vermont. Everyone has guns. Some don’t use them, but their parents or grandparents hunted, and they inherited the guns and the culture of hunting. The guns are simply part of the family history that evolved from the need to hunt to survive; to the need to experience hunting.

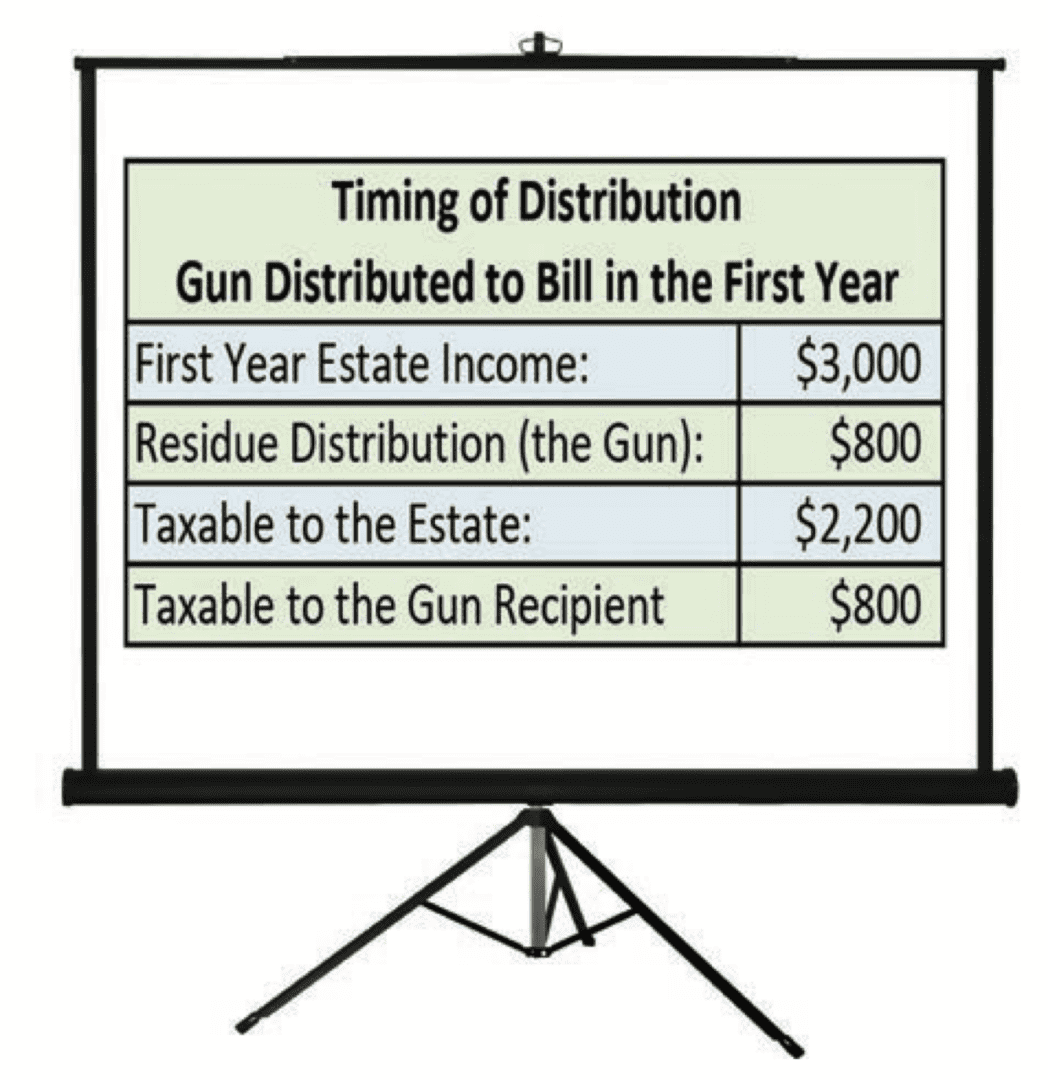

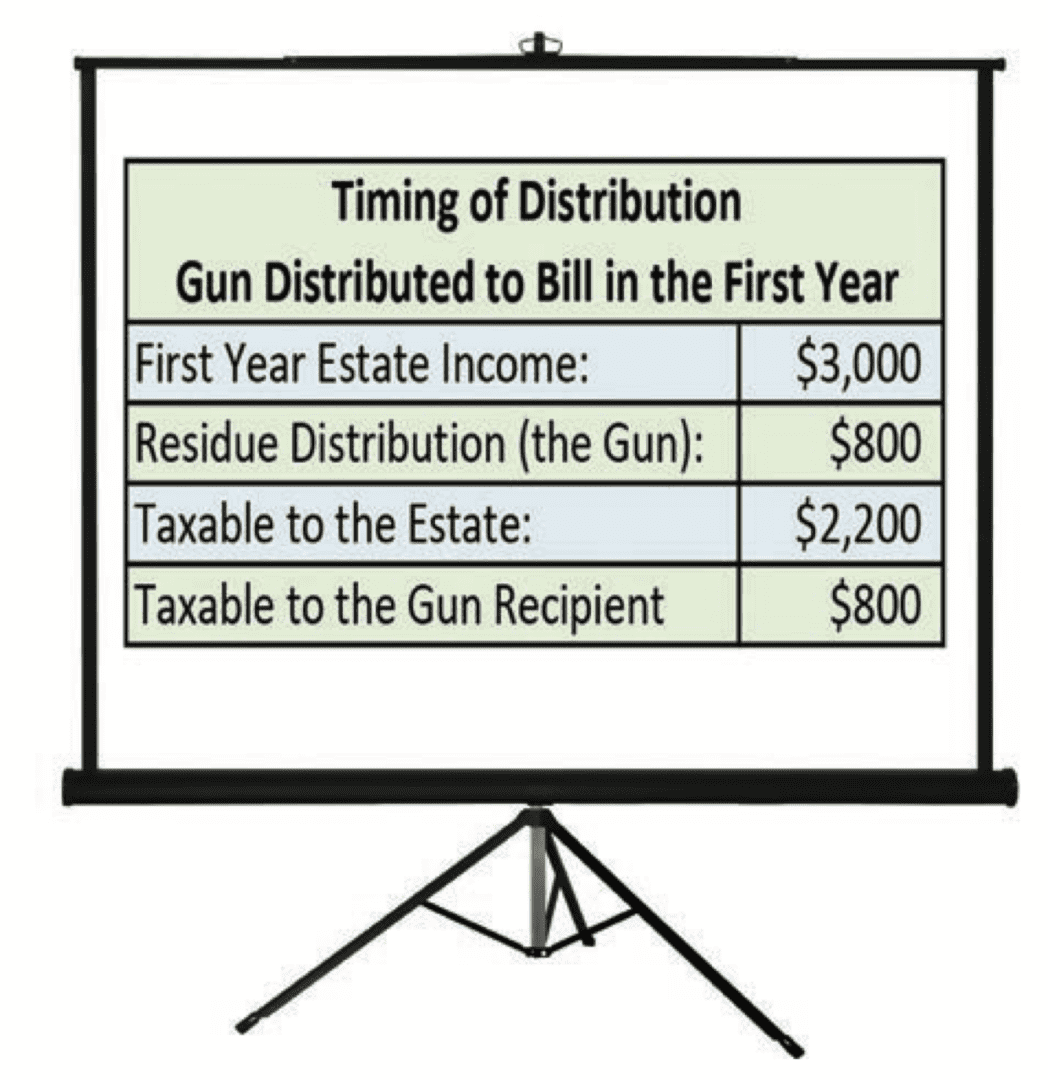

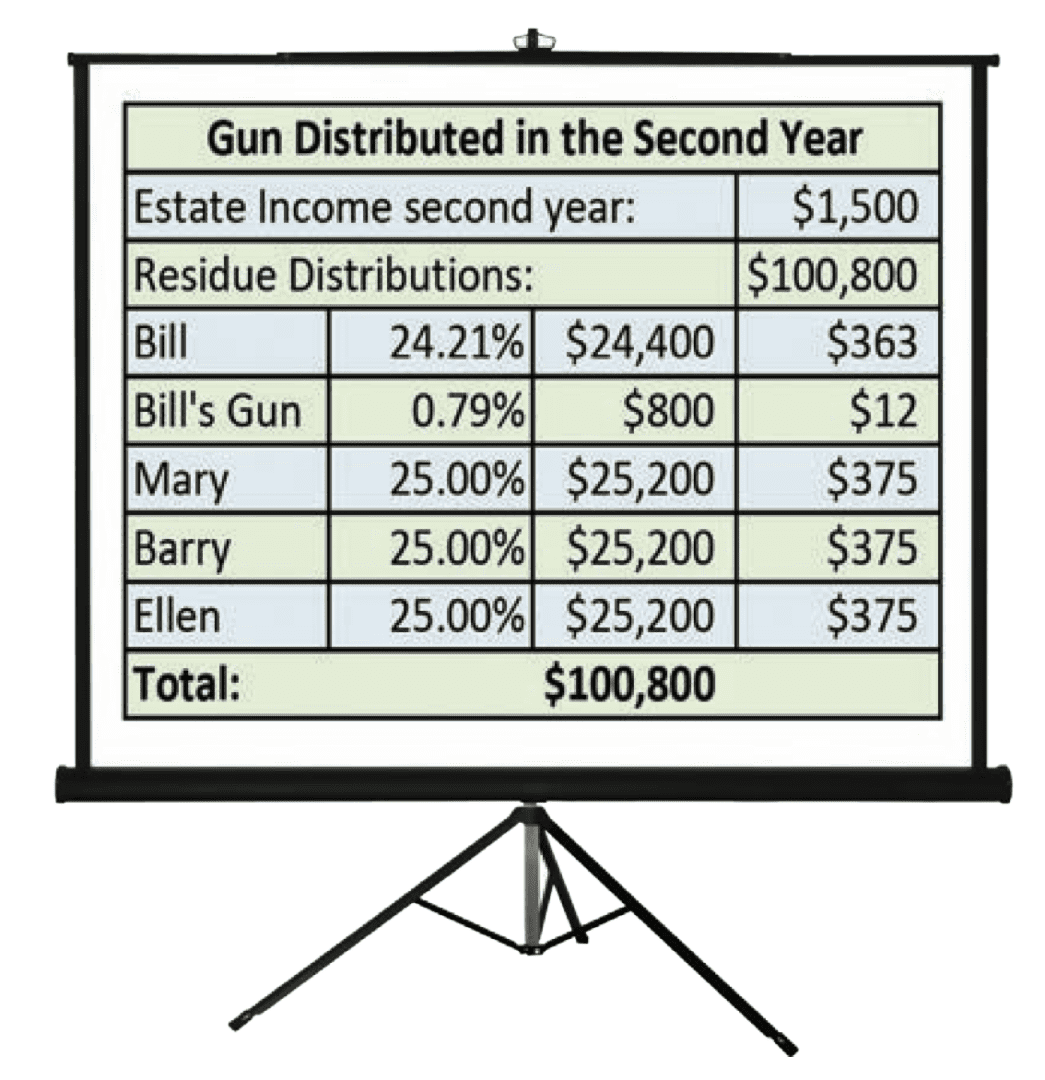

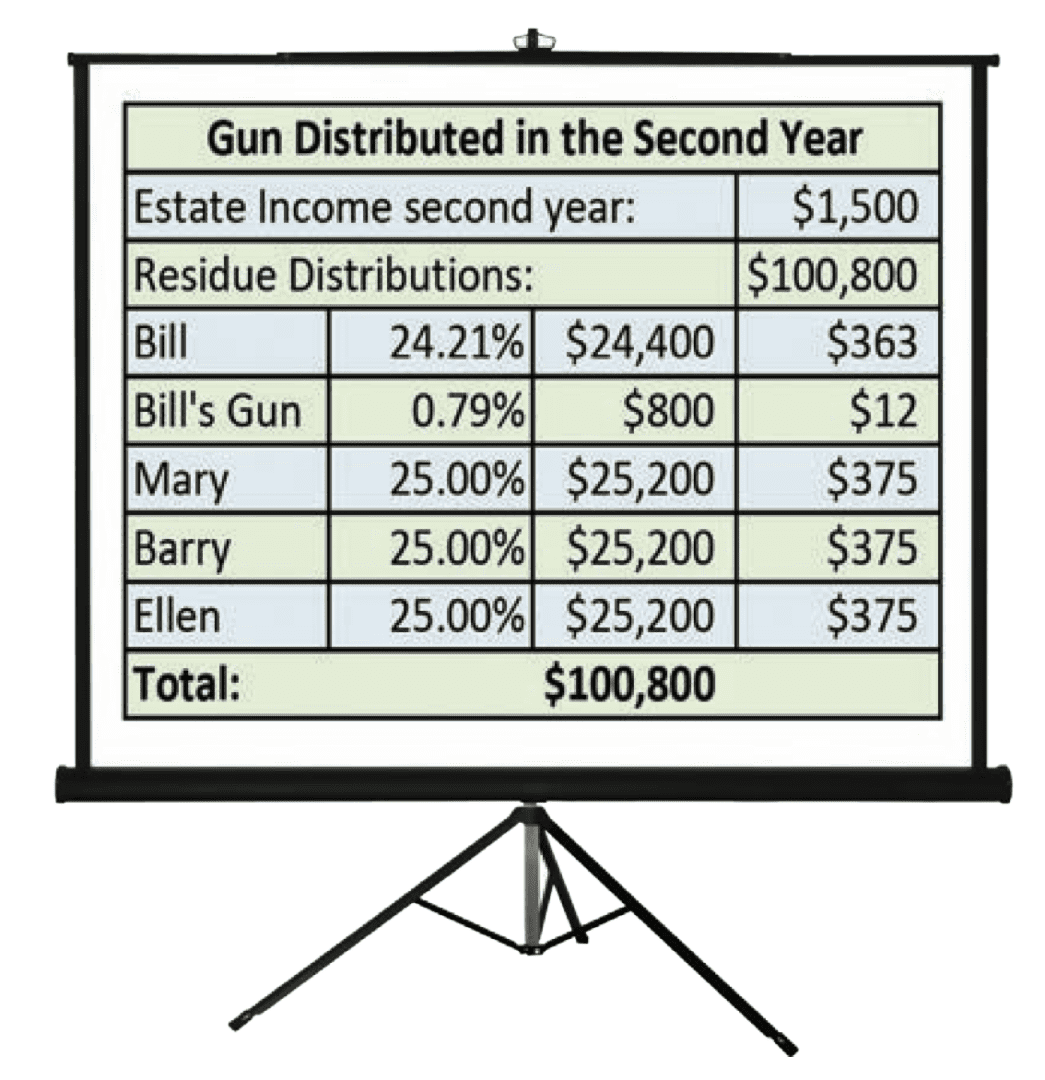

I was handlIng an estate In the early 70s. The es- tate included one gun. One of the beneficiaries came into my office and asked for the gun as part of his share. I gave him the gun. The gun was worth $800. A few months later I sent him a tax letter to tell him to report $800 as taxable income. He was not happy. The Estate probably only had taxable income for the year of less than $3,000. Taxable income often goes out based on distributions for the year. In this example, $800 was taxed to the beneficiary and $2,200 to the Estate. If I had made the distribution in the next year, when I made final distributions from the Estate, the tax would have been spread among all the beneficiaries and the tax letter may have been $12.

Sometimes, when asked to lecture, I tell the story that involved this gun and the tax implications. My presentation consisted of two slides.

Then one day my slideshow changed. I added a new slide. I had evolved. I should have evolved sooner. What was I thInkIng? I focused on the tax implications. I dId not focus on the gun!

Under the exIstIng law, if I had distributed a gun to a felon, I could be criminally liable. I don’t want any of my colleagues to focus on timing distributions and discover that our next meeting will be in jail. Guns are regulated at both the federal level, such as the Gun Control Act (“GCA”) and the National Firearms Act (“NFA”), as well as the State laws and regulations. The laws governing weapons are complex and need to be addressed with the attorney. Tax strategies may be the least of our worries.